From a revenue stand point, medical image sensor market will grow at a significant 9% CAGR in the 2012-2017 period, and is expected to reach $112M in 2017. X-ray image sensors account for 93% of total medical image sensors market revenue due to the ultra expensive price of X-ray sensors.

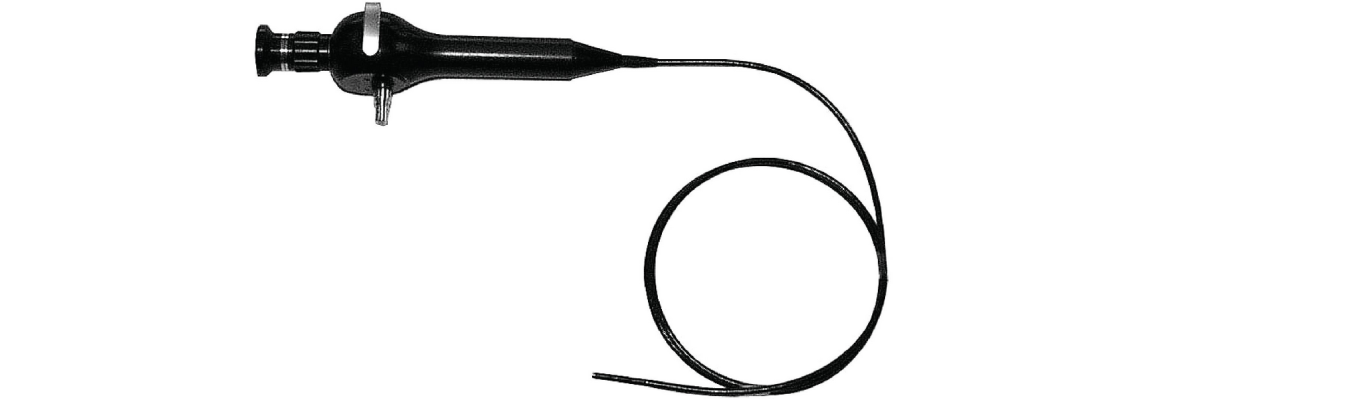

The solid-state medical image sensor market is driven by two major applications: X-ray imaging and endoscopy.

Medical image sensor shipments will increase from 1.8M units to 4.2M units in 2017, fueled by growing sales of disposable endoscopes and camera pills. These emerging products will find broad adoption in clinical practices owing to incentives being provided in Europe and the US to reduce nosocomial infections.

In this report, you will find details on the market evolution in revenue, volume and wafer shipments.

INNOVATIVE PRODUCTS GIVE RISE TO NEW APPLICATIONS AND CREATE NEW MARKETS

The medical image sensor market is characterized by a straight duality between X-ray imaging and endoscopy applications on price and volume. X-ray imaging is a very high-end market with a multitude of players, while endoscopy market is a high volume and low price point market with a limited number of players.

Seven segments are identified and need to be considered separately because they implicate different supply chains, drivers, and technical specifications. In this report, each of these segments is described with market drivers & technology trends.

X-ray and endoscopy markets are in evolving quickly, and are the source of numerous innovations at both equipment and application levels. Emerging products like disposable endoscopes, camera pills and CMOS X-ray flat panels are poised to drive the growth of medical image sensors in both volume and revenue, and help new players to enter the market.

MULTIPLE TECHNOLOGIES IN COMPETITION TO DOMINATE THE MEDICAL MARKET

Three technologies are currently used in medical imaging: CCD, CMOS and amorphous silicon (a-Si).

CMOS image sensors are a decade old technology, but a second wave of innovation has recently taken place and CMOS image sensors will quickly gain market shares in both endoscopy and X-ray markets at the expense of CCD sensors and a-Si flat panels.

CCD technology will continue to dominate historical endoscopymarkets i.e. flexible and rigid endoscopy, growing at a moderate rate of 6%.

X-ray imaging and amorphous silicon detectors will stay the mainstream technology for very large static X-ray imaging thanks to their cost effectiveness.

A new X-ray technology mixing CMOS circuits and advanced packaging technologies is currently under development by all major players of X-ray imaging such as Philips or Siemens. That technology, namely Single Photon Counting is expected by 2017 and is the next milestone of X-ray medical diagnostic.

In this report, you will find detailed markets forecasts by product & technology, along with application & technology trends.

NEW OPPORTUNITIES TO ENTER THE MEDICAL IMAGING MARKET

That technology shift in endoscopy and X-ray imaging represents a major opportunity for new entrants to take positions in the medical imaging market in niche, but nevertheless fast growing, applications. Numerous companies have entered the endoscopy market by offering innovative disposable endoscope or cameras pills, similarly to CMOS X-ray flat panel detector vendors.

Currently some historical players like Karl Storz or Hoya in endoscopy, or Trixell and General Electric in X-ray, have stood back. But what will they do as these growing markets will reach critical size? Some acquisitions have already occurred, and are ideal for big players to quickly complement their product portfolio and keep offering leading edge products with low technological risk.

This report includes the key companies to watch and their positional strength in the supply chain.