blog

Shark -The new resectoscopes from Richard Wolf Richard Wolf resectoscopes for urology have formed a platform for therapeutic and diagnostic interventions at the highest level for many decades. The new…

ENDOCAM® Logic HD ENDOCAM® Logic HD is the logical advanced development of existing camera systems from Richard Wolf. Sophisticated development processes and the exceptional expertise within the company have created…

KeyPort – The reusable Single Port solution from von Richard Wolf It also offers users decisive benefits such as: reusability an exceptional level of surgical freedom a modular setup and…

Source: American Journal of Gastroenterology . Nov1973, Vol. 60 Issue 5, p466-472. 7p. 6 Charts, 1 Graph. Author(s): Papp, John P. Subject Terms: *ENDOSCOPY *X-rays *GASTROINTESTINAL system — Diseases *ABDOMINAL…

This course is available to GI nurses and reprocessing technicians who are interested in thoroughly understanding the procedures for endoscope care and reprocessing. Participants will learn to recognize the important…

When it comes to mediastinal and hilor staging of lymph nodes, the EBUS-TBNA scope is setting a new standard. It’s designed to let you take advantage of high-quality ultrasound imaging.…

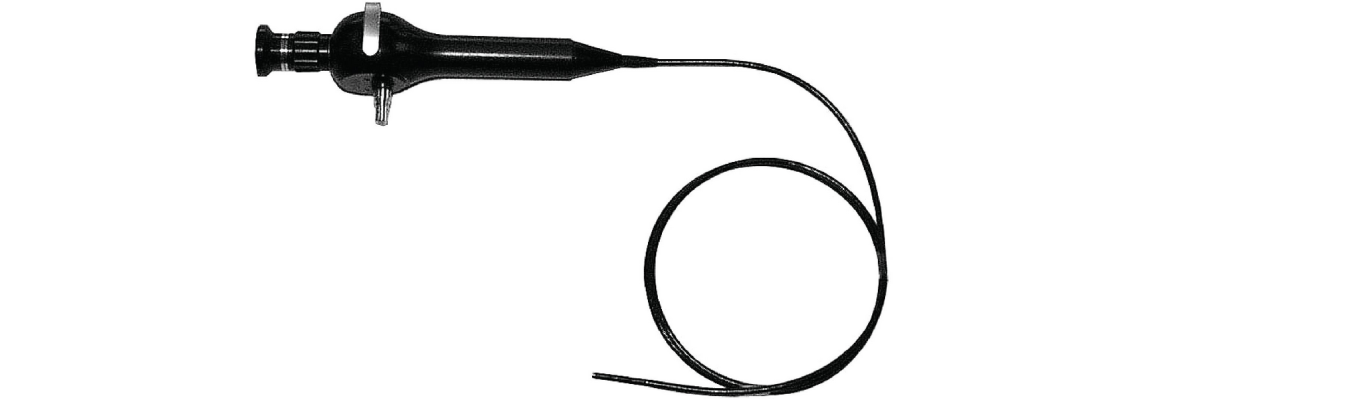

Small diameter fiberscopes can inspect narrow areas or where access is limited and are available in 0.64 mm, 2.4 mm or 4.1 mm. Each model has an ocular focus to…

The IPLEX RX/ IPLEX RT are lightweight industrial videoscopes that feature the unique PulsarPic image processor to produce exceptionally high-resolution and bright images. They have a large 6.5-inch screen with…

A high-end industrial videoscope system combining portability with advanced functionality, and ease of use with durability. From high image quality inspection to retrieval operation, the versatility achieves various benefits beyond…

Standard Range Fiberscopes achieve the highest image quality in 6.0 mm, 8.4 mm and 11.3 mm diameter at lengths of up to 3.0 m. All models feature four-way angulation and…