Improved visualization, diagnostics efficiency, and the superior flexibility provided to surgeons are spurring adoption of endoscopic surgical techniques.

Extraordinary developments have occurred in the field of endoscopy over the past 40 years. The era that began with the fiber-optic endoscopes (fiberscopes) has now moved to the videoscopes. Incorporation of multimodal features is already under way and the ideal endoscope of the future may permit rapid switching from white light endoscopy to magnification endoscopy, multi-band imaging and perhaps electronic microscopy, and endoscopic ultrasound (EUS).

For the next decade, more complex therapeutic procedures will be performed by a new group of therapeutic endoscopists using advanced videoscopes. Several new therapeutic procedures will emerge but natural orifice transluminal approaches will need to compete with advances in laparoscopic techniques. It is also likely that health administrators faced with escalating medical costs will demand that new and more expensive procedures not only facilitate patient care but also result in superior health outcomes.

The market for endoscopes is showing great promise and with time, demand is expected to increase, resulting in steady growth. The large number of medical centers in the country along with the ever-increasing number of new centers being set up will ensure that the demand never fades. As more and more medical centers opt for the instrument, the market will be benefited and players will be able to earn higher profits.

Market Dynamics

The global endoscopy equipment market was worth Rs. 38,874 crore in 2012 and is expected to reach Rs. 61,560 crore by 2017, growing at a CAGR of 9.7 percent from 2012 to 2017. The global endoscopy devices market witnesses high competitive intensity as there are many big and small firms with similar product offerings. The market is dominated by Olympus Corporation with 70 percent market share, in 2011. Hoya Corporation (Pentax Medical System), Fujifilm Holding Corporation, Karl Storz, Boston Scientific, Stryker, Richard Wolf, Smith and Nephew Inc., are some of the prominent players in the global endoscopy market.

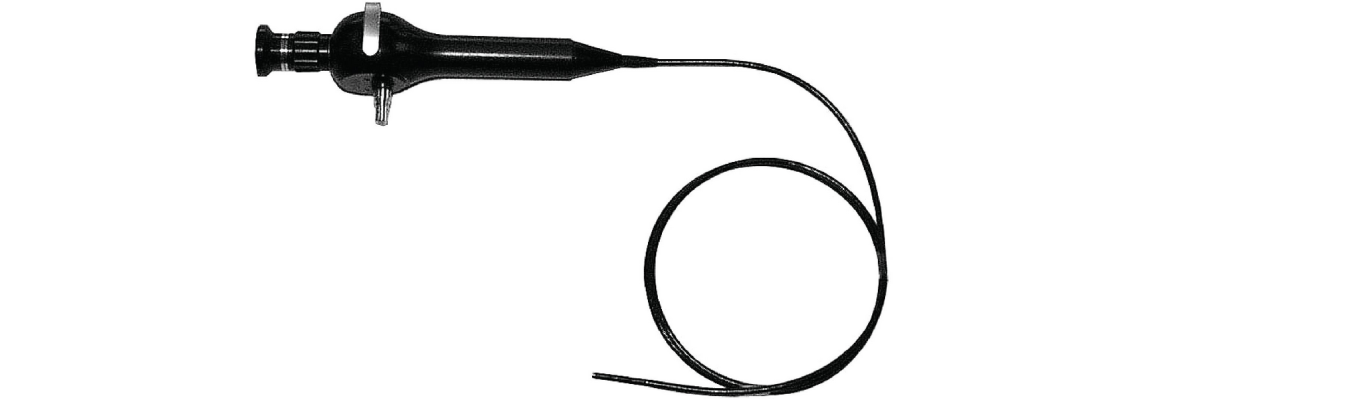

Global endoscopy market is broadly segmented into the following product categories – rigid endoscopes, flexible endoscopes, endoscopy visualization systems, endoscopic ultrasounds, endoscopy fluid management systems, and endoscope accessories. Introduction of new, but expensive technologies such as HD cameras, 3DHD systems, HDTV three-chip systems, narrowband imaging, capsule endoscopy, natural orifice transluminal endoscopic surgery (NOTES), picture archiving and communication systems (PACS), mucosal ablation therapy, robotic endoscopes and the like are expected to drive the global endoscopy market for the coming five years.

Flexible endoscopes formed the largest category in the overall endoscopes market. Endoscopic accessories and flexible endoscopes are the leading product segments prevalent in the global endoscopy equipment market.

The United States represents the single largest market worldwide. Growth in this market is led by rising demand for minimally invasive surgical procedures, high prevalence of colorectal, and other gastrointestinal-related diseases, and increasing health awareness among the patient base. New advancements in the medical field and introduction of preventive medicines are resulting in increase in endoscopy and other minimally invasive procedures in the country. Asia-Pacific is forecast to emerge as the fastest growing market with a projected CAGR of 7.6 percent. Major markets for endoscopy equipment in Asia-Pacific include China, India, and Taiwan. Asian countries are slated to register a maximum CAGR of 14.42 percent owing to increased healthcare spending by the government, healthcare reforms, and increased patient awareness about minimally invasive surgeries (MIS).

Endoscopy has been witnessing strong gains supported by gradual establishment in endoscopic imaging as the primary technique for detection and treatment of chronic and acute diseases driven by its unique capability of targeting hard-to-reach areas. Endoscopy procedures are also affordable and safer, and enable quick recovery, in comparison with conventional methods making them the apt choice for gastroenterology, gynecology, otolaryngology, laparoscopy, and urology. Supported by technological advancements, latest imaging technologies and changing patient demographics, the market is expected to post robust growth in the coming years. The increasing preference for disposable devices over reusable equipment is also driving growth in the market. Other growth factors include increasing healthcare awareness in developing economies, improving healthcare facilities, and adoption of high-end healthcare services.

The equipment market has also received a major boost from the growing popularity of endoscopic surgeries. Acceptance of endoscopic surgical techniques among general practitioners and specialists alike is a key factor driving demand in the market. Major factors spurring adoption of endoscopic surgical techniques include superior flexibility for physicians to perform surgeries in their offices, reduced recovery times, lower risks of secondary infections, and better patient outcomes.

Technology Trends

Traditional training has focused on histology as the final arbiter of gastrointestinal (GI) and other pathology. However, as endoscopists, histology is rarely used for the diagnosis of duodenal ulceration or reflux esophagitis. Furthermore, disorders such as stromal neoplasms, pancreatic rests, and lipomas often have characteristic endoscopic appearances that can be difficult to confirm by biopsy. In case of neoplasms, endoscopic appearances are highly reliable for the diagnosis of most GI carcinomas but are less reliable for early carcinomas and for the differentiation of adenomatous from hyperplastic colonic polyps. These areas of uncertainty have encouraged the evolution of diagnostics aids that may increase the accuracy of endoscopic diagnoses and perhaps obviate the need for histological evaluation.

Current aids in the process of evaluation include high-resolution high-magnification endoscopy, chromoendoscopy, narrow and optimal band imaging, autofluorescence imaging, confocal laser endomicroscopy, and endocytoscopy. Other light modifications that are still in the development phase include light-scattering spectroscopy, Raman spectroscopy, and optical coherence tomography. An important aspect of the future of endoscopy is the role of conventional histology. At a practical level, it would be helpful to rapidly and accurately differentiate hyperplastic from adenomatous colonic polyps and to differentiate dysplastic from non-dysplastic tissue in Barrett’s esophagus. It would also be helpful to have a simple, single, and highly accurate test for identification of helicobacter pylori. In real-time histology, endoscopes such as endocytoscopes and confocal laser endomicroscopes can magnify surface features up to similar levels to those obtained with a high-power microscope. However, these or similar endoscopes are unlikely to enter mainstream gastroenterology in the near future because of increasing costs, growing requirements for contrast agents, and difficulties with the prediction of pathology based on surface characteristics.

Future innovations may include molecular imaging techniques that use specific antibodies labeled with substances such as fluorescein that might be readily detected with inexpensive technologies. After a technology has been shown to be clinically useful, the extent to which it is adopted into clinical practice relies on several other issues, such as cost, reimbursement, ease-of-use, availability of training, inter-observer agreement, and procedure duration.

Another major leap forward would be the capability of remote control of the capsule’s movement in order to navigate it to reach designated anatomical areas for carrying out a variety of therapeutic options. Technology for improving the capability of the future generation capsule is almost within grasp and it would not be surprising to witness the realization of these giant steps within the coming decade.

Capsule endoscopy. Capsule endoscopy was launched at the beginning of this millennium and has since become a well-established methodology for evaluating the entire small bowel for manifold pathologies. A capsule endoscopy procedure requires a disposable camera capsule, a data recorder to record the data transmitted by the capsule, and a workstation to view the data collected; therefore, the market for capsule endoscopy encompasses all three devices. The global capsule endoscope equipment market is expected to reach Rs. 1600 crore in 2017. Increased adoption of capsule endoscopy, along with advancements in technology and the availability of high-definition (HD) systems are set to drive the global capsule endoscope equipment market. Since one camera capsule is used per procedure, the number of camera capsules purchased increases proportionally with the number of procedures performed and constitutes a majority of sales in the market.

Vendors have introduced advanced and expensive products in the endoscopes market. Endoscopes are used not only for diagnostics but also for therapeutic purposes and thus they deliver good therapeutic solutions by facilitating close monitoring of the body as well as internal organs.

NP Single balloon enteroscopy (SBE) is similar to double balloon enteroscopy (DBE) except for the fact that the former utilizes a single balloon on the overtube and a hyper-flexible endoscope tip. This decreases set-up time. The single balloon enteroscope is also stiffer that may facilitate one-to-one advancement in the small bowel and improve success rates for ileal intubation from the anal approach. In the initial clinical experience using SBE, average depth of insertion (270 cm) and diagnostics yield (54 percent) were similar to those with DBE. The procedure time was somewhat shorter. There are no comparison studies between DBE and SBE with regard to complete enteroscopy rates. Spiral enteroscopy is a completely new technology that consists of a 48 French rotating overtube with spiral threads. The spiral overtube can be backloaded on a double or single balloon enteroscope.

After intubation of the stomach with the enteroscope, the overtube is rotated clockwise through the upper GI tract until the spiral threads engage in the jejunum beyond the ligament of Treitz. Once free in the abdominal cavity, clockwise spinning of the overtube results in rapid pleating of small bowel onto the overtube. At present, spiral enteroscopy is limited to the oral approach.

Advanced technologies such as narrow band imaging, confocal microendoscopy, and HD cameras have resulted in the generation of high-quality images, which in turn have increased the rate of detection and accuracy of diagnosis. Visualization systems for endoscopy, in particular, are expected to witness demand surge due to the advent of HD cameras, 3DHD systems, and growing usage of HDTV three-chip systems in hospitals. The emergence of new technologies that promise to improve visualization and diagnostics efficiency is therefore expected to positively benefit the market for endoscopes and related equipment.

Increasing complexities as new imaging tools and NOTES while evolving rapidly, shall continue to present seemingly limitless possibilities for innovation, technique, and device development.

Second Opinion

See More and Biopsy Less

ImageOver the past few decades, endoscopes invaded into the diagnostic armamentarium of several medical and surgical specialities. The initial investigation of choice remained endoscopy because it is operator dependent, affordable, and performed by none other than the clinician himself. From the gastrointestinal endoscopy point of view, the practitioner from the community level to tertiary care center, everyone feels the need for this service. To cater to different needs of the segment, market leaders make economy models with basic functions to the sophisticated equipment with lot of frills. China has made an impact in the basic segment in the last few years, which was dominated by Japan and Europe till recently.

Increased demand for the endoscopy leads to focus on efficiency. From the technological angle, the major endoscope companies like Olympus, Pentax, and Fujifilm are coming with wide screen displays with full HD resolution. Image copying, transferring, and archiving which used to be difficult earlier are made simple now. Newer colonoscopes with 330 degree full spectrum vision are nothing but a delight to the performer. Next-generation video processors are coming to power the endoscopic equipment including endoscopic ultrasound. The concept of see more and biopsy less has made manufacturers concentrate on high-resolution HD imaging in all endoscopy segments. Narrow band imaging in cholangioscope is an example. I believe the drive for key growth lies in this segment, which is a benchmark for further minimally invasive endoscopic surgery.

The market for the reprocessed endoscope is another unexplored and unorganized market in India. A huge proportion of buyers of new equipment have no idea of what to do with the working older models. Administrators and finance managers of institutions want the purchases to be viable and cost effective and expect the returns in a time frame. Luckily, the workloads of most centers are encouraging and the management is willing to invest.

There is enough opportunity for further development and research in each area. The challenge is cost cutting without compromising the quality.

Image”Technology is moving toward the LED light, which is not only cost effective but also adheres to go green environment initiative with no glass fiber, less electricity consumption and heat generation. High-definition viewing is another technology, which has become popular giving the endoscopist vivid image. Private sector investment in healthcare has fueled the growth of medical equipment business. Opportunity is the size of the Indian market which still allows space for startup companies to keep struggling and makes a mark for themselves. Also the traditional Indian values of personal attention and service make a company to standout and survive. Indigenous manufacture of endoscopes and other medical equipment shall insulate the domestic market from currency fluctuations and outflow of precious foreign exchange. Healthcare shall also penetrate more across the country as cost-of-ownership of sophisticated medical equipment is coming down due to indigenous manufacture.”

Jaideep Datta

General Manager,

Mitra Medical Services