Investing in medical technology companies oftentimes requires looking beyond the pure play companies to look at conglomerates (after all, the leading three medical technology companies are J&J, Siemens and GE). One such company is Olympus, the Japanese manufacturer of optical equipment. Olympus has a leading market share in endoscopes and indeed was the first to commercialize the predecessors of current endoscopes in the 1950s. More recently of course, Olympus has been the focus of attention for their accounting fraud scandal first uncovered by the ex-CEO Michael Woodford.

If you have an appetite for complexity and risk, Olympus might of course be worth a look as an investment and the argument goes something like this:

the endoscope market is healthy and growing (demand driven by aging in the developed world and infrastructure investments in the emerging world)

Olympus is an undisputed leader in the field

the endoscope business is the core of Olympus and past source of the majority of its profits

there is relative value and at current market capitalization (even after having recovered a bit) you might pick up Olympus at a discount to the value of its medical business alone

While I agree with the first two points, three and four are more tricky.

Here is my the counter-argument.

There currently is too little clarity on the true earnings power of Olympus. The company has published the independent report of the investigation into the scandal which shows how losses were hidden for a long time in Enron-style off-balance sheet vehicles. It remains vague though as to the source of those losses and only refers to investing in “high risk high return products, risky financial products that offered interest advancement and the riskier and complex structured bonds”. What if (as originally considered as a pure theoretical option here) Olympus were to actually cover up not (only) for an unrelated financial speculation gone wrong but for the profitability of the business being lower than stated?

There are only moderate signs at best of wanting to clean up the governance to get to the core. The newly proposed board structure puts a creditor representative as Chairman (he is ex-SMBC) and a company insider (prior Director of the Medical Unit) with no previous experience in managing a large company in crisis as their Representative Director and President.

While there clearly is interest in the endoscope business from strategic and financial buyers (TPG, Sony and Fujifilm have all been rumored to be interested), there still is of course the danger of a Japanese style issuing of fresh capital to a friendly corporate Japanese investor at unfriendly and dilutive terms to existing shareholders to bridge the gap in equity as a result of the large losses.

Instead of investing in Olympus, I would like to suggest an alternative idea.

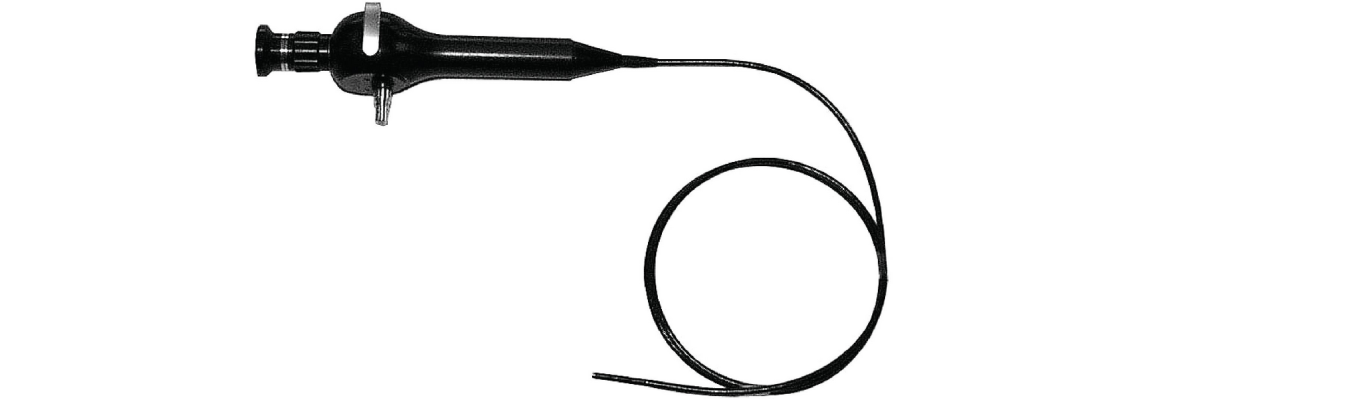

The second in global market share for flexible endoscopes is Hoya, which acquired Pentax, the brand under which these endoscopes are sold, in 2007.

Hoya produces other optical technology bundled under the segment Information Technology (mainly mask blanks and photomasks for semi-conductor and LCD panel production and lenses for all types of cameras) in addition to their Life Care segment (which includes eyeglasses and contact lenses, bio-compatible ceramics for implants and endoscopes). The Life Care segment accounts for slightly more than 50% of sales (around 2.5bn USD) and pre-tax profits (around 450m USD) and last year grew at 12% with strong demand from emerging markets. If anything, the Olympus scandal should be either neutral or even positive for their endoscope business.

But best of all, Hoya — without any known governance problems — passes my value screen. It is sufficiently large (close to USD10bn market cap) and conservatively financed (equity ratio of 65%) with an unassuming valuation at an earnings yield of over 7%, a dividend yield of 3.5% and a 10year PE of 15.5 (it even provides the 10 year earnings history which oftentimes is so difficult to find right on their investor relations homepage).

Disclosure: I have no positions in either Hoya or Olympus but might follow my own reasoning in the near future