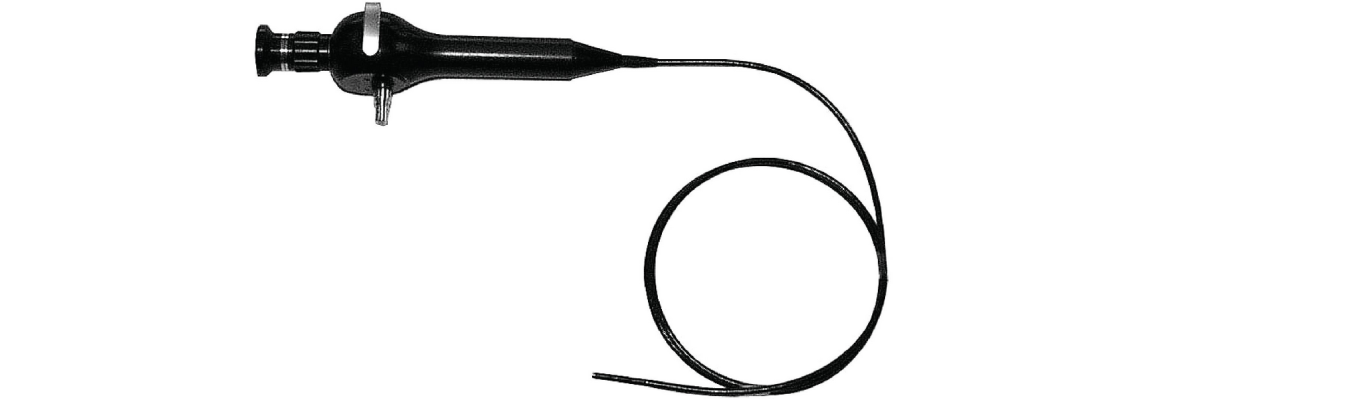

According to Millennium Research Group (MRG), the global authority on medical technology market intelligence, revenues for endoscope services will grow moderately in the United States through 2021. Due to the…

Earlier this year, French 3-D technology and product lifecycle management company Dassault Systèmes unveiled a new electronic initiative aimed at helping medtech firms create fully-traceable, compliant product development processes that…

Initial comments: This blog, written by Lawrence F Muscarella, PhD, discusses whether 2% glutaraldehyde formulations and peracetic acid solutions, either of which may be used to achieve high-level disinfection, might…

Faster recovery times, better prognosis, and higher awareness among physicians and patients have been the foremost drivers of endoscopy in diagnosis and surgical disciplines in Australia, South Korea and Southeast…

ALPHARETTA, Ga.—EndoChoice, Inc., a platform-technology company focused on gastrointestinal (GI) endoscopy, announced today that it has acquired RMS Endoskopie-Technik, an endoscope manufacturer headquartered in Elmshorn, Germany, near Hamburg. RMS was…

The Alpharetta firm closed on $43 million, merged with Peer Medical Ltd., and then bought a German endoscope manufacturer. A few days after Alpharetta-based EndoChoice Inc. closed a $43 million…