The Endoscopy Division of FUJIFILM Medical Systems USA, Inc. provides excellent endoscopic imaging and advanced endoscopic technology for healthcare professionals and the patients they treat in the fight against colon…

Fujinon’s new endoscopy system is a new imaging experience. It includes a 23″ monitor for HDTV display of images obtained. The monitor is highly luminous and displays colours brilliantly and…

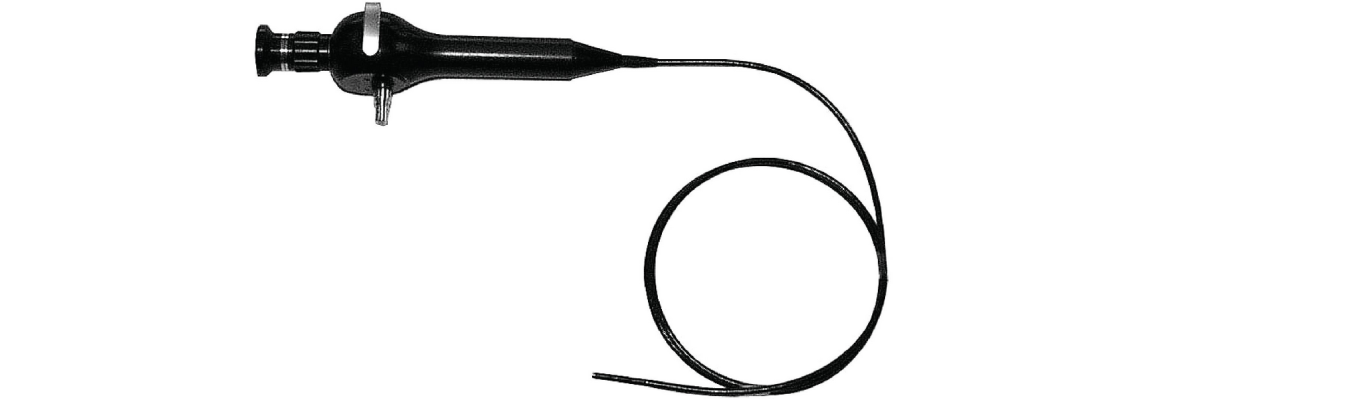

Industry-leading Fujifilm innovations include the transnasal endoscope and double-balloon endoscope. We take a comprehensive approach to endoscopy that goes beyond imaging instruments and technology to provide personalized service, support, and…

In consumer applications this Fujufilm’s announcement would sound like from 10 years ago. But medical market is different: “Fujifilm is proud to make use of the over-megapixel customised CMOS sensor.…

The Endoscopy Division of FUJIFILM Medical Systems Europe will showcase a number of advances at the occasion of the UEG week which will be held in Berlin from 12 to…

Industry experts discuss the big trends and developments in gastroenterology/endoscopy today and where they are headed in the future. This article is sponsored by Endoscopy Division FUJIFILM Medical Systems U.S.A.,…

FUJIFILM Corporation (President and CEO: Shigetaka Komori) has announced that it acquired 100% equity in Turkey’s sales agency for endoscopy products, FILMED TIBBI CIHAZLAR PAZARLAMA VE TICARET A.S. (hereinafter “FILMED”),…

We primarily use two medications to sedate our patients. Fentanyl is given for any discomfort (cramping) you may have. Versed helps patients relax. The combination of these medications helps to…

Mauna Kea Technologies, which develops optical biopsy products, announced today that one of its products, Cellvizio, has received State Food and Drug Administration (SFDA) approval in China, one of the…

The Aspire Bellus, a dedicated breast imaging workstation will be showcased by FUJIFILM Medical Systems U.S.A. Inc. at the 99th annual meeting of the Radiological Society of North America (RSNA)…